私たちの強み

経験豊富なバイリンガルチーム

国内外のジャーナリストやグローバル企業と連携し、日英両言語でのスムーズな情報発信を実現。文化的ニュアンスを理解した翻訳・通訳で誤解をゼロにします。

KPIドリブンのイベント設計

独自のリアルタイムダッシュボードを活用し、リード数・メディア露出・エンゲージメントを可視化。データに基づく改善提案でROIを最大化します。

危機管理PRの専門知識

危機発生時のゴールデンタイム(72時間)を逃さず、メディアブリーフィングと社内連携を迅速化。ブランドを守るための体制を事前に構築します。

サービス

企業イベント企画・運営

キックオフ、株主総会、製品発表会など、目的に応じた会場選定からシナリオ作成、当日のエグゼクションまで専任ディレクターがフルサポートします。

メディアリレーションズ & プレスカンファレンス

200社以上の報道機関と築いたネットワークで、正確かつスピーディーな情報発信を実現。ニュースバリューを高めるストーリーテリングで報道価値を最大化します。

社内コミュニケーション戦略

従業員エンゲージメントを高めるタウンホールミーティング、社内SNS運用、CEOメッセージ動画など多彩な施策で組織力を底上げします。

実績

TechExpo2023 グローバルローンチ

ハイブリッド形式で開催し、来場者エクスペリエンスを向上。リアルタイム配信とメディアブリーフィングを組み合わせた成功事例。

- 来場者: 4,500名

- メディア掲載: 120件

- SNSインプレッション: 2.3M

MajorPress 新サービス記者発表

危機管理要素を含む短納期プロジェクト。迅速なメディア対応とステークホルダー調整でブランドイメージを強化。

- TV露出: 8局

- 記事掲載: 35件

- NPS: +55

プロセス

- 01 相談・ヒアリング: 課題と目標を明確化。オンライン/オフラインでミーティングを実施。

- 02 企画提案: KPI設計を含む具体的なプランと見積を提出。

- 03 準備・制作: 会場手配、台本作成、メディア告知など全工程を管理。

- 04 実施・運営: 当日は統括ディレクターが進行。リアルタイムでリスクモニタリング。

- 05 効果測定 & レポート: 独自ダッシュボードでデータ分析し、次回改善提案を実施。

テクノロジー

バーチャルイベントプラットフォーム

3D会場とアバター交流で没入感を提供。国内外からの参加者がシームレスにネットワーキングできます。

メディアモニタリングAI

自然言語処理による感情分析でポジティブ・ネガティブを即時判定。24時間体制でブランドセンチメントを監視します。

パフォーマンスダッシュボード

Google Data Portalと連携し、投資対効果をリアルタイムで把握。意思決定を迅速化します。

サステナビリティ

-

ペーパーレス運営

QRコード受付とデジタル資料で年間15,000枚の紙を削減。環境だけでなく運営コストも最適化。

-

カーボンオフセットオプション

イベントのCO₂排出量を試算し、再生可能エネルギー証書へ投資。企業のESG評価向上に貢献。

-

地元サプライヤー優先

大阪府内のパートナーと連携し、輸送コストと排出量を大幅削減。地域経済の活性化にも寄与します。

お客様の声

チーム

佐藤 健一

代表取締役 / CEO

20年以上にわたり国内外のPR案件をリード。最新トレンドを取り入れた戦略設計が強み。

田中 玲奈

PRディレクター

メディアリレーションズと危機管理PRの専門家。ジャーナリストとの強固なネットワークを保有。

高橋 大輔

シニアイベントマネージャー

大型カンファレンスから社内イベントまで総指揮。緻密なオペレーションで高評価を連発。

お問い合わせ

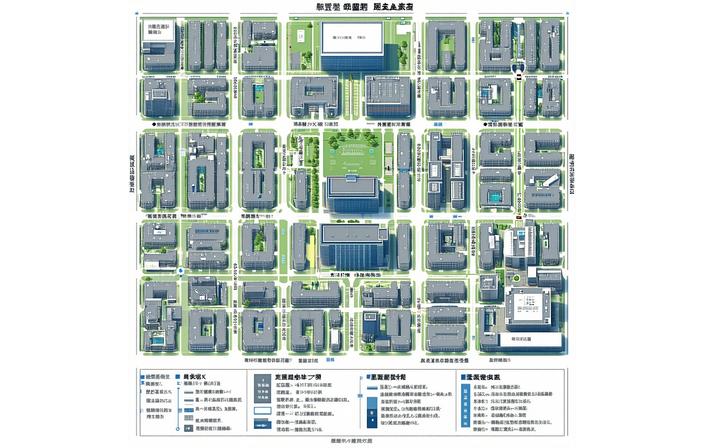

所在地

〒542-0081

大阪市中央区南船場3-1-12 心斎橋グランドビル8F

電話

06-6245-XXXX

メール

営業時間

平日 09:00–18:00 (JST)